The Startup Fundraising Playbook

DocSend Startup Index provides data-driven insights into what the latest fundraising trends are and how to succeed.

About Our Research

DocSend’s fundraising research, the DocSend Startup Index, provides insights into how startups raise capital at various stages in their lifecycle. We study how founders craft their pitch decks, seek meetings, and pitch investors in order to uncover fundraising trends and evaluate changing investor behaviors.

Our data-driven research demystifies the startup fundraising process and answers many questions founders have about what goes into a venture-backed raise.

Our Approach to Research

We combine survey data on elements like demographic trends and investor outreach strategies with proprietary data from DocSend’s platform that reveals how pitch decks are structured and consumed. We also use qualitative data from industry experts that highlights lived experiences behind the numbers.

Contribute to Our Research

Pre-Seed Startup Fundraising: All You Need To Know

Pre-Seed Fundraising Trends

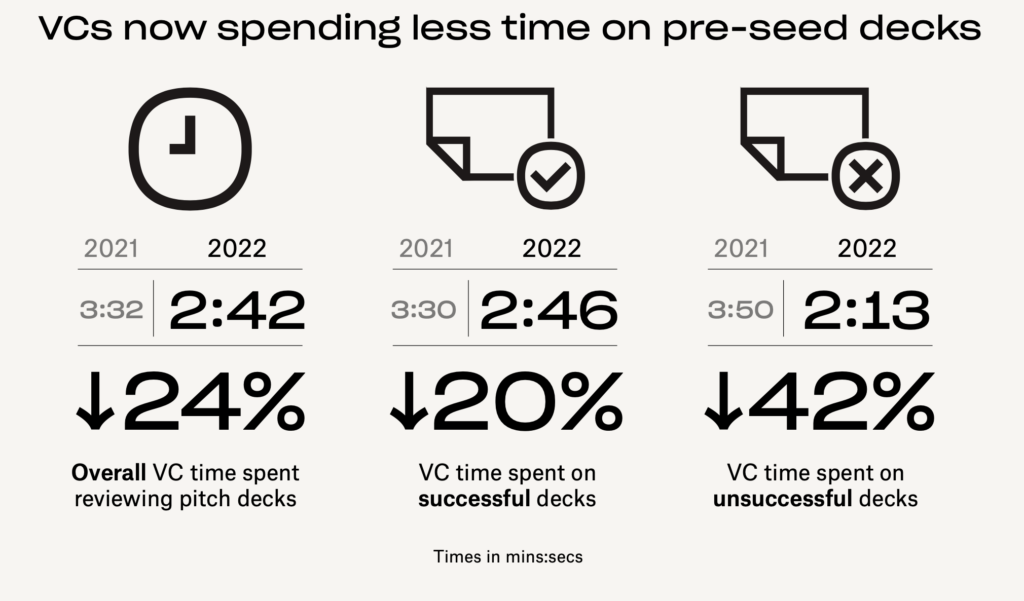

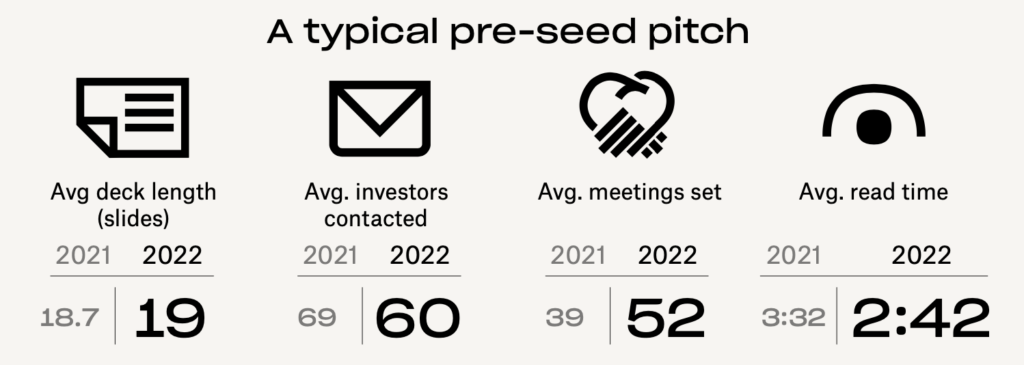

Between 2021 and 2022, we found that investors spent less time reviewing pitch decks than ever before. We also identified four new trends that have emerged alongside a more investor-friendly fundraising marketplace in 2022.

VCs now spending less time on pre-seed decks

Compared to 2021, investors have spent much less time scrutinizing pre-seed pitch decks in 2022. They’ve also become quicker to get to “no” with decks that don’t resonate.

When we compare first and subsequent visits to pitch decks, our data shows another sharp divergence between 2021 and 2022. Investors in 2022 are spending more time on follow-up visits for decks that don’t ultimately receive funding.

Read all pre-seed fundraising trends

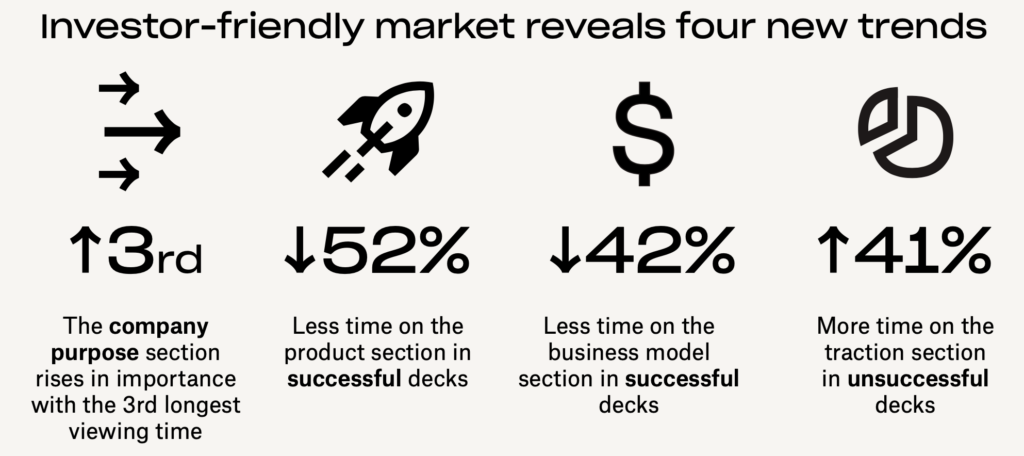

Investor-friendly market reveals four new trends

Between 2021 and 2022, four trends emerged in VC scrutiny of pitch decks. First, in 2022 VCs spent 52% less time on the product sections of successful decks. Second, they spent 42% less time on the business model section. These two trends mean that founders have less time than ever to make these all-important sections stand out. At the same time, the brief company purpose section was the third-most scrutinized section in 2022–this section was squarely in the middle of the pack in 2020 and 2021. Lastly, traction was a key factor differentiating unsuccessful decks: VCs spent 41% more time on this section in 2022 compared to 2021 for decks that didn’t receive funding.

Read all pre-seed fundraising trends

Pre-seed pitch deck trends: Compared to 2021, investors in 2022 spent 52% less time on the product section and 42% less time on the business model section. The company purpose section had the third-longest viewing time. Click To TweetAccess to pre-seed capital remains global

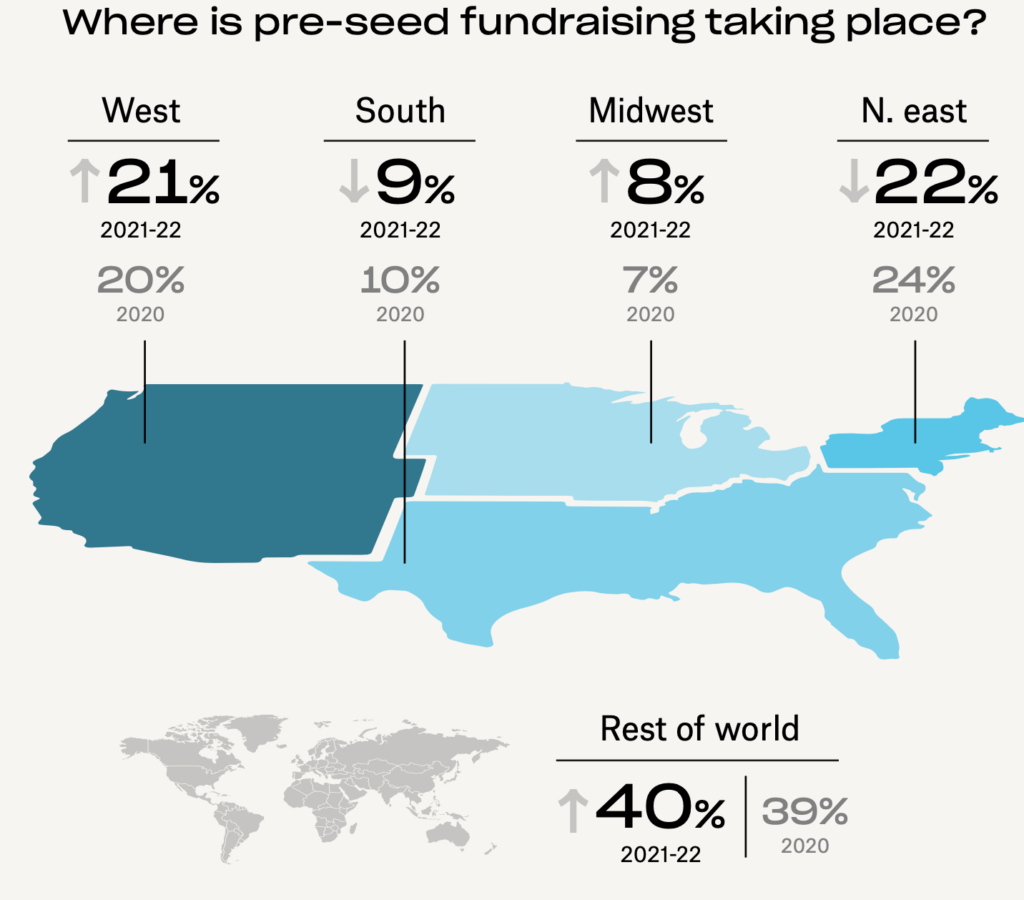

In 2021-22, the Northeastern United States had a plurality of companies in our dataset, with the Western United States hot on its heels. However, there is a higher percentage of pre-seed companies located outside the US than ever before. This geographic distribution suggests that easier access to capital from outside the traditional Silicon Valley hub is a post-pandemic trend that’s here to stay.

Pre-Seed Pitch Deck Analysis

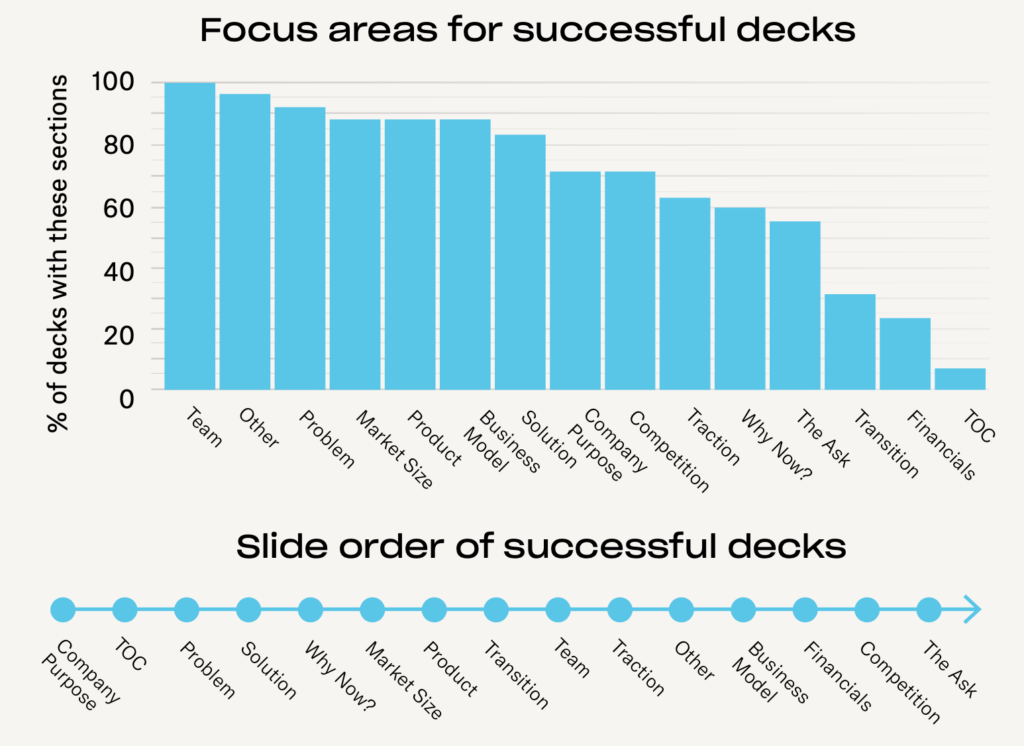

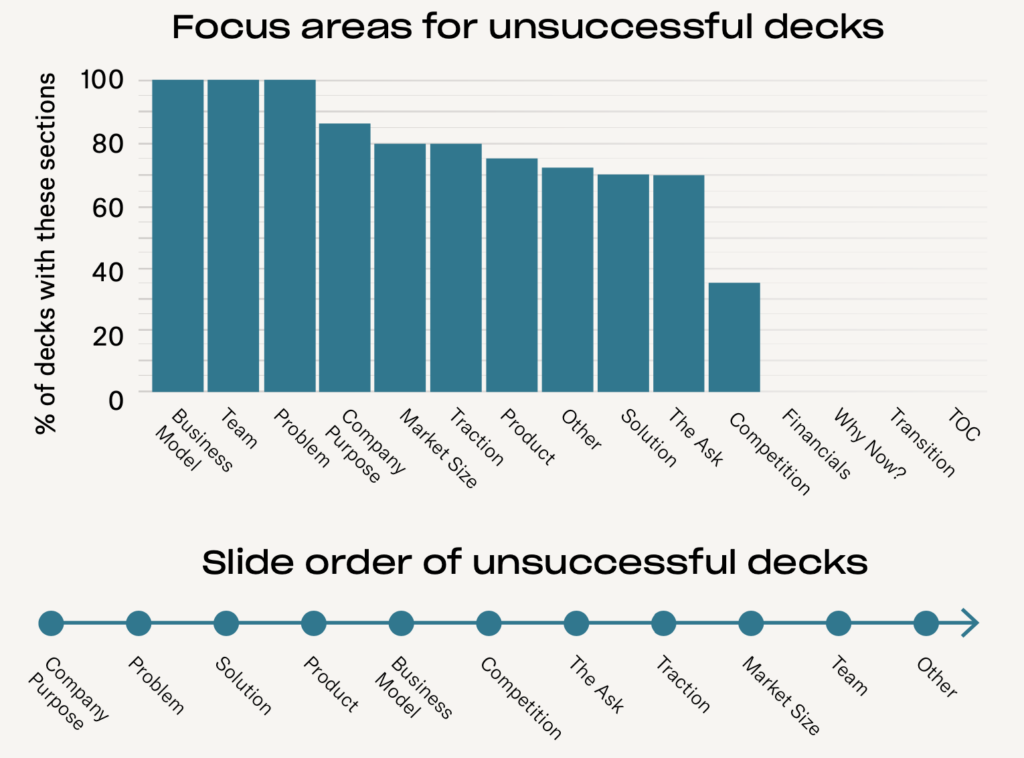

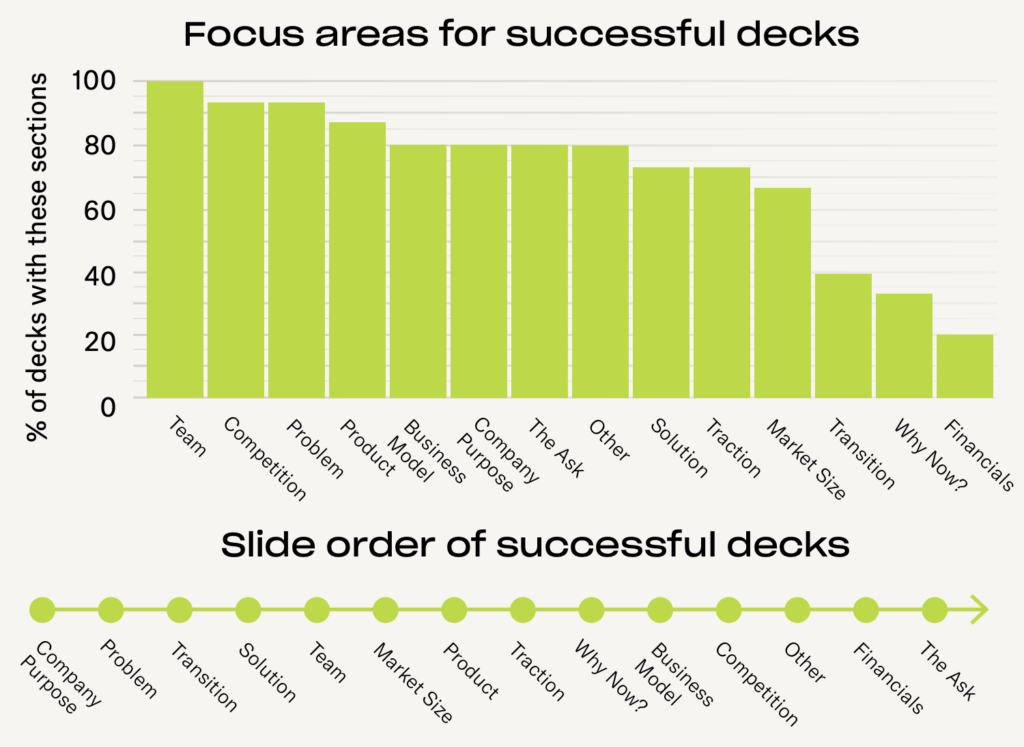

The order of sections within decks was broadly similar for successful and unsuccessful companies. Where both groups had a certain section, that section was roughly in the same place. However, successful companies in our dataset tended to have their business model and fundraising goals sections at the end of the deck, whereas unsuccessful companies put them at the beginning and middle, respectively.

Pre-Seed Pitch Deck Template

To help pre-seed founders create effective pitch decks, we launched a section-by-section guide to the art and science of pitch deck construction. This guide builds on our pre-seed research and highlights what’s unique about pre-seed decks compared to later rounds. We also created deck templates that founders can customize with their unique company stories.

Seed Startup Fundraising: All You Need To Know

Seed Fundraising Trends

VC caution increased in 2022 compared to 2021, and we found that investors spent less time than ever reviewing seed stage pitch decks. We also identified three trends that marked investor scrutiny in a more challenging fundraising climate.

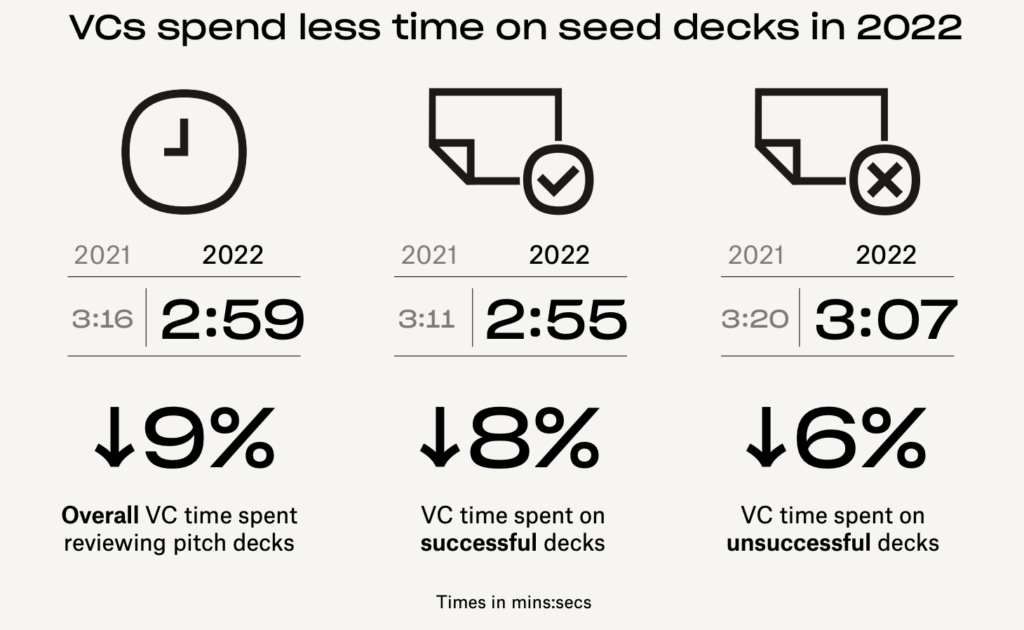

VCs spend less time on seed decks in 2022

As we saw at the pre-seed stage, investors spent less time scrutinizing seed decks (both successful and unsuccessful) in 2022 versus 2021.

When we compare first and subsequent visits to decks, our data again shows that investors moved through decks quicker in 2022. However, they gave a bit extra (critical) scrutiny to unsuccessful decks that failed to convince on a first read.

Read all seed fundraising trends

Seed fundraising trend: Investors spent 233% more time on the business model sections of decks in @DocSend’s data set that didn't get funded. Click To TweetInvestors zero in on three differentiators in 2022

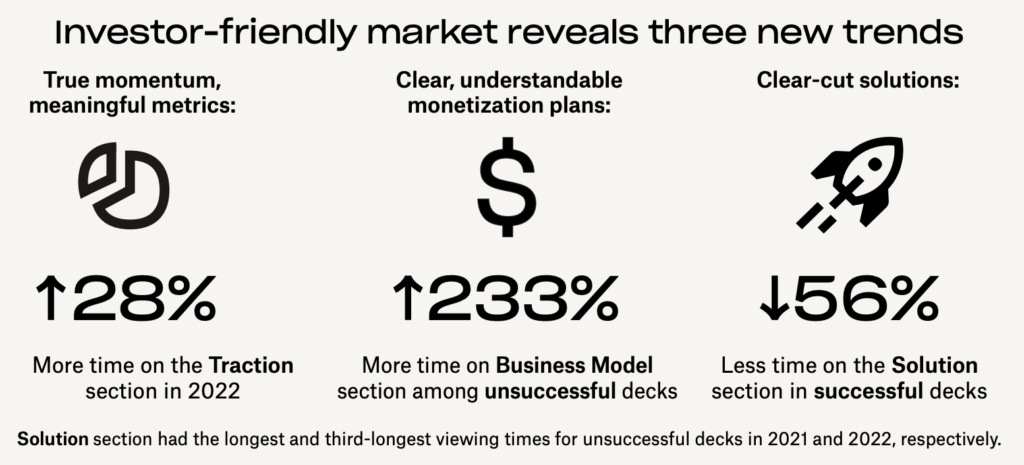

VCs grew more cautious in 2022, and our data shows three key trends in how they evaluated seed companies. First, even though time-on-deck metrics fell overall, VCs spent 28% more time on the traction sections of decks that got funding in 2022 compared to 2021. At the same time, they spent 56% less time on the solution sections of successful decks. Finally, VCs spent 233% more time scrutinizing the business model sections of decks that ultimately didn’t get funded. These trends signal that investors prioritized clear and concise storytelling but leaned in on meaningful traction metrics as signs of momentum at a time of economic uncertainty.

Read all seed fundraising trends

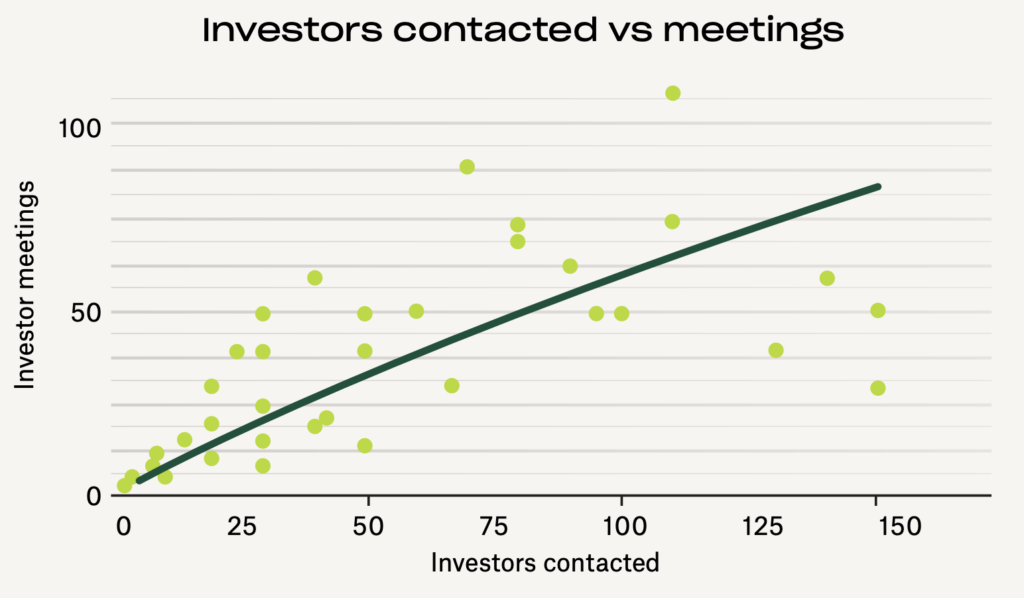

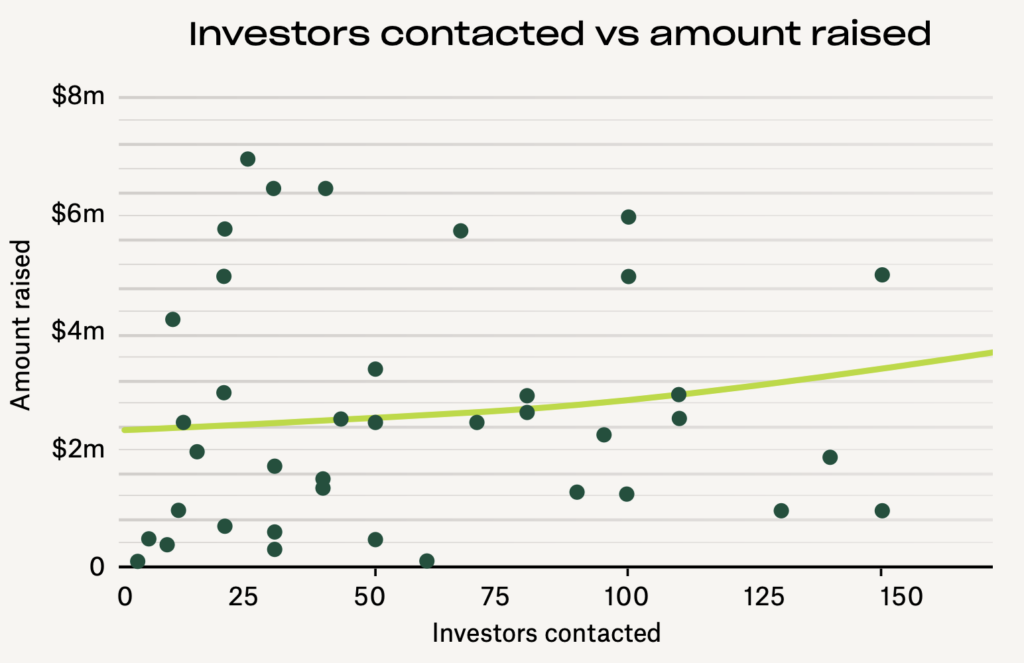

Contacting more investors doesn’t yield better results

Reaching out to more investors can yield more meetings, but our data shows that many successful founders raised their seed round by contacting 80 or fewer VCs. There was a much weaker correlation between the number of investors contacted and the amount of funding raised. Seed founders should continue to build relationships with the right investors who fund companies in their field instead of creating time-consuming outreach plans. Pitching smarter, not harder, continues to be an effective strategy.

Seed Pitch Deck Analysis

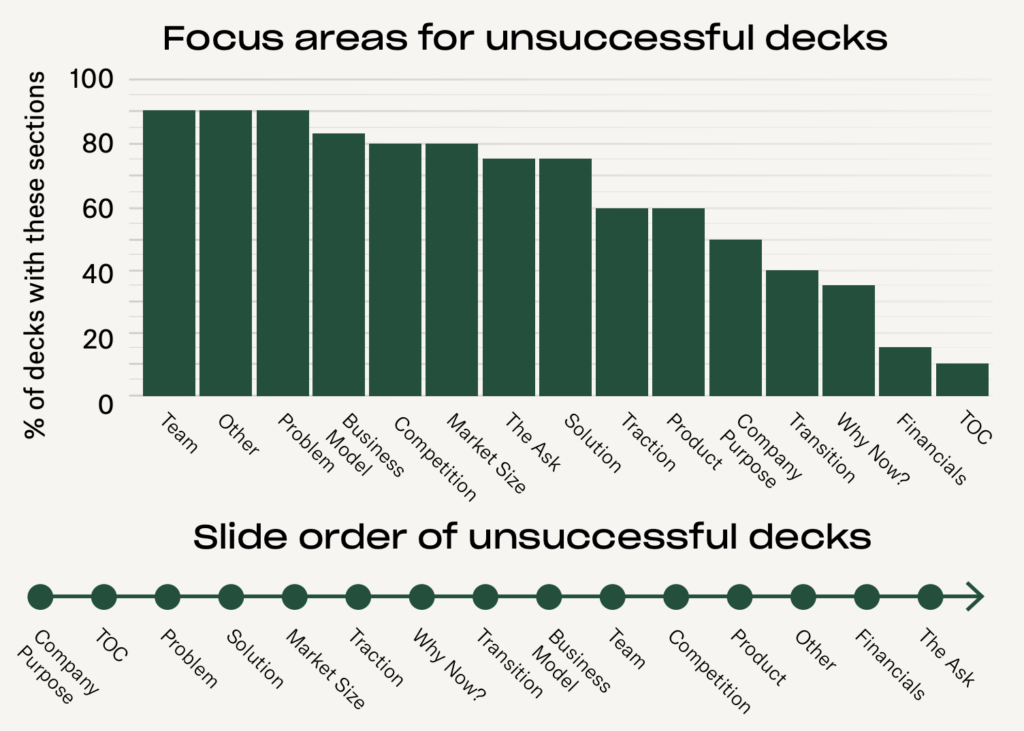

When it comes to the order of seed deck sections, several important patterns emerge when comparing successful and unsuccessful decks. Successful decks tended to put the all-important team slide toward the front of the deck whereas unsuccessful ones more often put it near the middle or end. Relatedly, unsuccessful decks tended to put their product section at the middle of the deck whereas successful decks highlighted it up front.

Seed Pitch Deck Template

To help seed stage founders build effective pitch decks, we launched a section-by-section guide to the art and science of pitch deck construction. The guide builds on our seed research and shows how seed decks differ from pre-seed decks. We also created deck templates that founders can customize with their unique company stories.

Series A Startup Fundraising: All You Need To Know

Series A Fundraising Trends

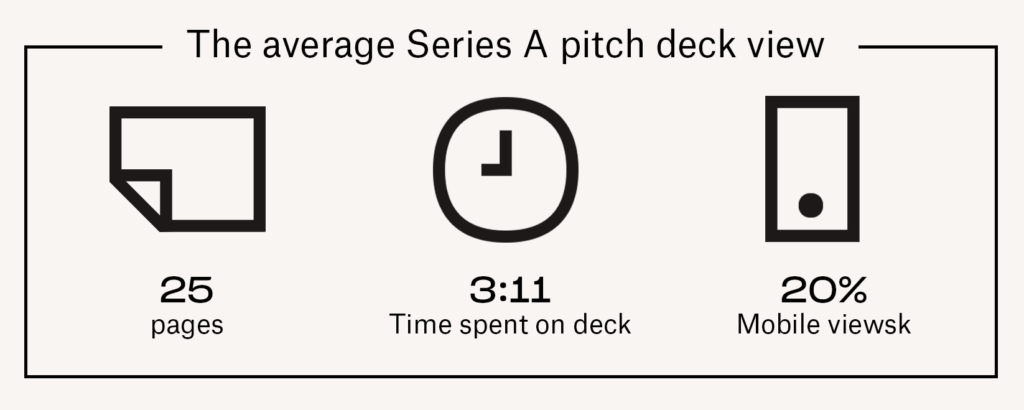

Succeeding in Series A fundraise calls for a more forward-looking approach. The rounds are much bigger and the meeting acceptance rate is much higher. Investors want to see scalability and positioning for the future.

Successful Series A decks focus on the future

Read all Series A fundraising trends

Traction needs to be repeatable and varied

One of the reasons Series A fundraising decks are longer is because companies need robust traction sections. Earlier-stage companies might show only one type of traction, whereas Series A companies need to show multiple forms of traction–such as awards or profit/loss metrics–to indicate to VCs the strength of the product/market fit. Further, companies need to show that these types of traction are repeatable over the long term.

Read all Series A fundraising trends

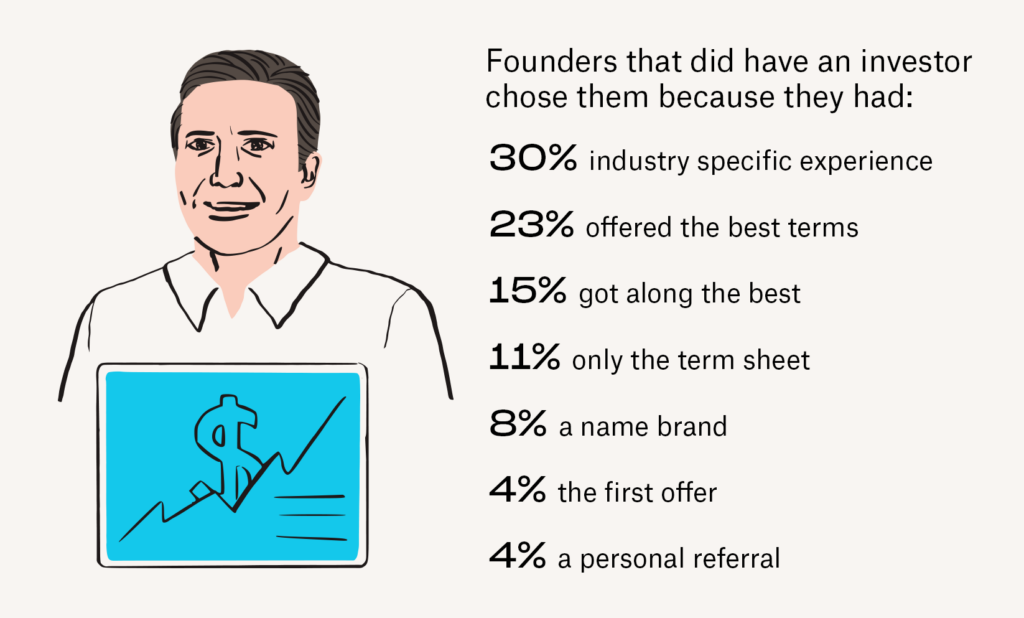

Choose your lead investor carefully

Nearly all (88%) of the companies that successfully raised had previous investors participate in their Series A round. But how do companies choose who leads the round? Only 8% of companies reported choosing a lead based on a brand name; by contrast, 30% chose their lead because they had industry-specific experience, and 23% because their lead offered the best terms. These figures show that the name on the check matters less than the type of deal being made or the sector expertise and connections a lead investor can offer.

Series A Pitch Deck Analysis

Read all Series A fundraising trends

Series A pitch deck trend: Investors at the Series A round tend to spend more time on three key sections: product, business model, and solution vs. purpose, why now, and competition in seed decks. Click To TweetGender & Race Bias in Startup Fundraising

Disparate impacts of fundraising slowdown

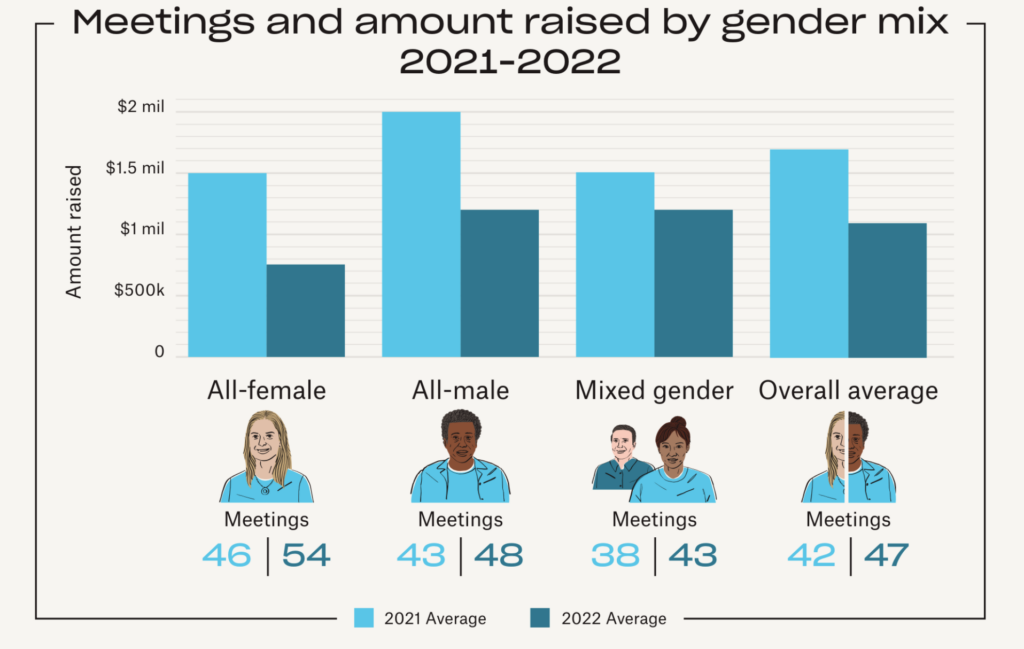

The macro environment in 2022 created a challenging climate for founders raising capital, but not all teams have been impacted equally. On the one hand, our data showed that early-stage (pre-seed and seed) teams raised less amid broad economic uncertainty and investor hesitation. On the other hand, all-female teams and teams with minority members experienced unique challenges.* For example, all-female teams raised 36% less than all-male teams, down from 25% less in 2021.

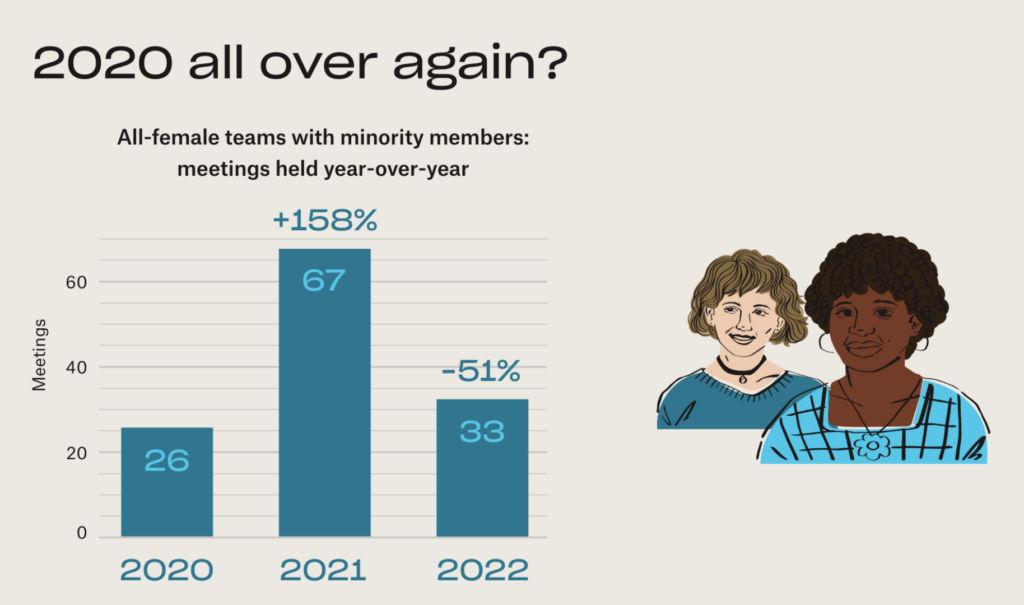

In 2021, all-female teams with minority members had the largest year-over-year gains in investor meetings held. In 2022, however, the average number of meetings for these teams fell back to 2020 levels.

Read more about fundraising bias

Pitch deck scrutiny and gender

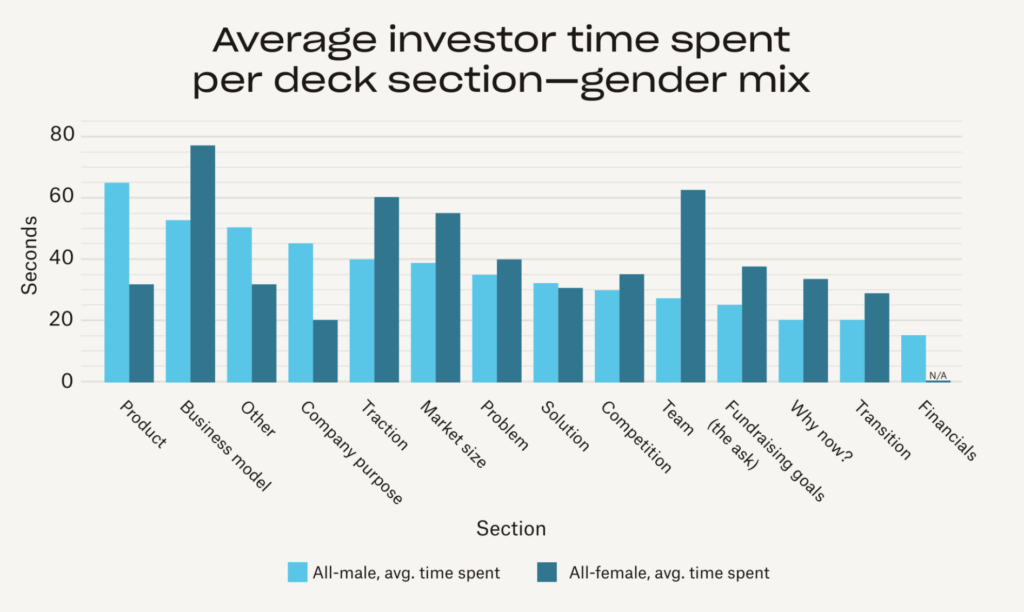

As in previous years, investors in 2022 spent the most time overall scrutinizing the team sections for all-female decks, averaging 125% more time on this section than for all-male teams. Equally in keeping with prior years, all-male team slides had one of the lowest viewing times.

VCs spent 103% more time on the product sections for all-male decks and 125% more time on their company purpose sections, as well.

Read more about fundraising bias

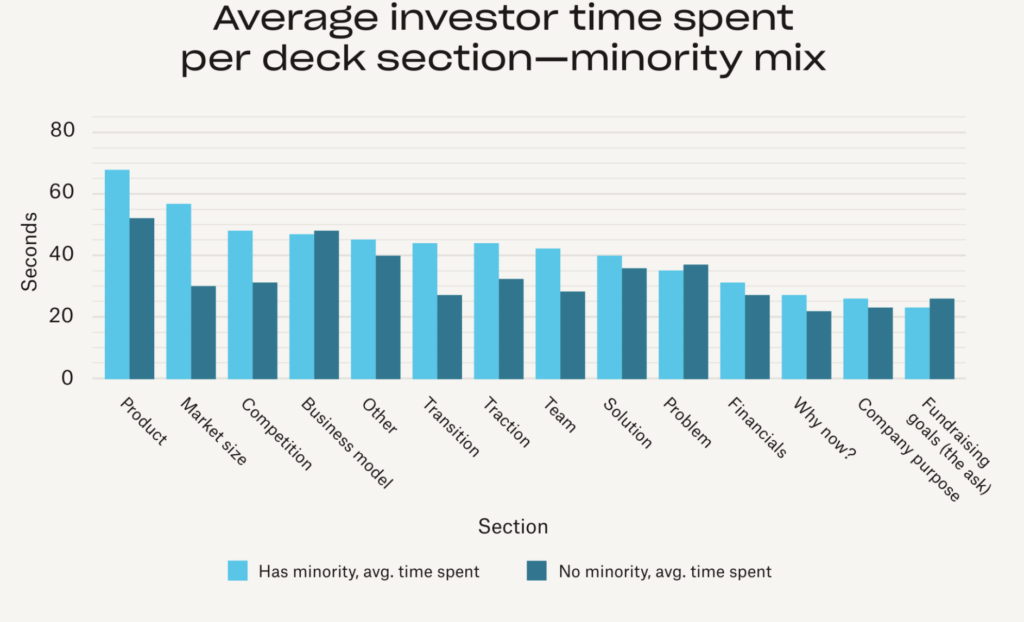

Pitch deck scrutiny and race

When we break down deck scrutiny by racial demographics, four sections stand out where diverse teams received more scrutiny than all-white teams. First, VCs spent 25% more time on the team sections for diverse teams compared to all-white teams. They also spent 28% longer examining the traction sections of diverse teams.

Investors also spent 55% more time on diverse teams’ competition sections compared to all-white teams. The largest discrepancy emerged when comparing market size sections: VCs spent 67% more time on these sections when it came to diverse teams.

Read more about fundraising bias

Pitch Deck Interest Metrics

- Founder links created: Number of pitch deck links founders send out

- Investor deck interactions: How actively VCs are on those decks

- Investor time spent: Average time investors spend reading decks

To learn more about our Pitch Deck Interest metrics and follow our regular analyses of fundraising activity, check out our weekly fundraising trends tracker.